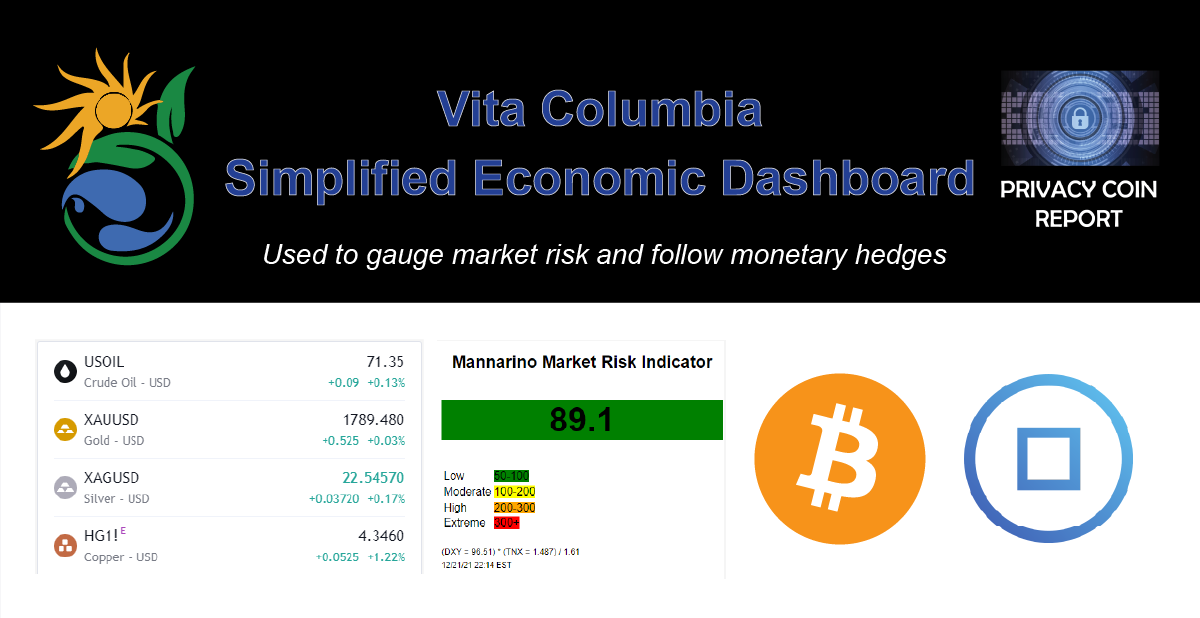

The Vita Columbia Simplified Economic Dashboard can be used to gauge risk in credit-derived markets and the credit-derived monetary system. The Vita Columbia Simplified Economic Dashboard contains 5 indicators: Crude oil, the Mannarino Market Risk Indicator (MMRI), monetary metals (gold, silver, copper), Bitcoin, and RYO Currency.

Risk Indicators

- Crude Oil

In 1971, the United States (US) was bankrupted from the cost of the Vietnam War and unable to make payments to foreign creditors in Gold at $35 per ounce. Then President, Richard Nixon took the US off the gold-standard, established a free-floating forex foreign currency exchange system and a perpetual expansion of the global currency supply was initiated to create the credit-derived monetary system. In effort to increase demand for USD, what followed was the creation of a petrodollar system, in which all oil sold by OPEC oil was to be traded in USD. OPEC oil profits would then return to the US by buying US assets (treasury bonds, stocks, real estate), inflating these assets to astronomical levels.It is critical to follow the price of crude oil, as a falling crude oil price could indicate a looming collapse of the petrodollar system, which could pose a significant threat to the status of the USD as global reserve currency and the credit-derived monetary system as a whole.

- Mannarino Market Risk Indicator (MMRI)

The MMRI, developed by derivatives and options trader Gregory Mannarino is used to gauge risk in the US stock markets and is calculated using the USD Index (DXY) and US 10-year treasury bonds. The MMRI rose sharply during several significant US Stock Market Crashes from 1987 to 2008.A rising MMRI indicates an impending collapse in credit-derived markets such as the treasury bonds, stock markets, and real estate. Learn more on how to interpret the MMRI.

Monetary Hedges

- Monetary Metals: Gold, Silver, Copper

For thousands of years, the monetary metals: gold, silver, and copper have been used as a means of exchange in mono- bi- and tri-metallic monetary systems. It is only since the 1960’s that silver was removed entirely from coinage, since 1971 that currency was no longer redeemable in gold, and 1990’s that copper was removed from coinage in some jurisdictions.A rising price in the monetary metals may suggest that confidence in the free-floating forex foreign currency exchange system is being eroded. Since 1971, there were several incidents in which the price of monetary metals skyrocketed.In the event that the credit-derived monetary system fails, the monetary metals would be one of the few safe haven assets, and the monetary metal system could even reemerge and have a significant role in the creation of a new monetary system.

- Bitcoin

Bitcoin is a decentralized digital currency, which was invented in 2008 by an unknown entity using the name Satoshi Nakamoto. Bitcoin is created as a reward for the processing of complex computational calculations, in a process known as mining. Bitcoin has a total market capitalization of almost $1 trillion USD, and is held by many large institutions. In September 2021, the Latin American nation of El Salvador adopted Bitcoin as legal tender, becoming the first nation to do so. Bitcoin can be fractionized into a smaller unit called Satoshi and can be held in digital wallets. Users can maintain total control of their Bitcoin holdings and access their funds using any device using their private keys or seed phrases.Like monetary metals, a rising Bitcoin price may suggest that confidence in the free-floating forex foreign currency exchange system is being eroded. In the event of failure in the credit-derived monetary system, Bitcoin may play a role similar to monetary metals, as a safe haven asset, and could sky rocket in price.

- RYO-Currency

RYO Currency is a decentralized and private cryptocurrency created in 2018, led by a prominent entity in the private cryptocurrency space going by the name of FireIce. RYO Currency offers privacy-by-default to all users, using advanced cryptography to ensure account balances and transactions remain untraceable. This ensures that RYO is inherently fungible, a characteristic lacking in the previous generation of transparent blockchains, such as Bitcoin. In the coming months, RYO will be implementing Halo Arc Generation 2 Zero Knowledge Proofs, the most technologically advanced cryptographic protocol to ensure privacy of users.In the event of failure in the credit-derived monetary system, privacy-preserving cryptocurrencies such as RYO Currency may emerge as a replacement for cash, as has been used since 1971 in the free-floating forex foreign currency exchange system.

____________________________________________________________________________________________________________

Disclaimer: All contexts of blog posts are based solely upon the analysis and opinion of the author and are not intended to construe any financial advice in any form.